In an industry known for its boom and bust cycles the forecast Canadian new building requirements over the next fifteen years should be signalling the start of another boom cycle in the shipbuilding industry. Shipyard executives are generally upbeat as their yards are starting to fill up with new building and repair work.

Kiewit Offshore services in Marystown, Newfoundland, is the shipbuilding partner in one of two teams competing to be selected as the builder of the Navy’s Joint Support Ship (JSS).

At Irving Shipbuilding in Halifax construction is about to begin on two cruise ships for Pearl Seas Cruises. These 91-meter vessels will carry about 165 passengers in considerable luxury.

At Davie Quebec they have contracted for two 130-meter offshore vessels with options on four similar ships. Construction will begin this year.

The Upper Lakes Group subsidiary, Seaway Marine and Industrial is beginning operation in the facilities previously used by Port Weller Dry Docks.

The Washington Marine Group (WMG) yards in North Vancouver and Victoria are members of the second JSS team and heavily involved with the project definition for the Navy’s Joint Support Ship, the construction of eight Orca-class training vessels for the Navy and the design and construction of an 125 car intermediate sized ferry for BC Ferries. WMG is also a member of the Victoria Class Submarine in-service support contract team.

At Allied Shipbuilders they have recently completed what has been termed as “a new build using existing components” when they increased the capacity of the MV Kuper from 26 to 35 cars for BC Ferries.

Robert Allan Ltd has had one of his tug designs selected as the “Tractor Tug of the Year” and has some 150 vessels of his design under construction around the world.

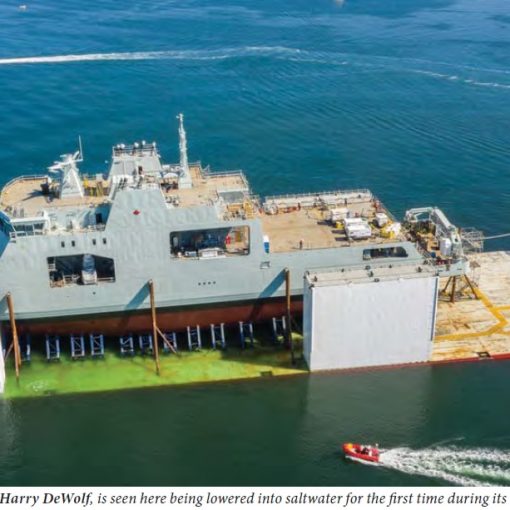

The Canadian Coast Guard is evaluating proposals to build eight mid-shore Patrol Vessels, the Frigate life Extension program is progressing through sign off and it has been announced that six-eight Arctic Patrol vessels will be constructed for the Navy commencing in 2015.

This is exciting for the industry and has attracted offshore companies to partner with Canadian companies to address the challenges of some of the larger and more complex projects.

The projected combined Navy and commercial domestic demand for new ships is calculated at about nine billion Canadian dollars. Of that about three billion will be for Canadian commercial ships. It is mandatory that the shipbuilding industry captures as much of the total demand as possible between now and 2020 if a viable modern shipbuilding industry is to be available to meet future Canadian requirements.

However there are forces at work that may deny this country the shipbuilding capability it needs and deserves. One of the economic goals of this and the last government is to negotiate and implement bilateral free trade agreements. This is a worthy goal. Yet what are the benefits to industries and individuals? Except in the most basic macro economic terms the benefits and for that matter the risks to companies and individuals have not been well articulated. Like motherhood and apple pie free trade is considered good in its own right. I suspect that apple pie (the thing) will not change but in the new environment what are the prospects for the baker, the apple grower, the sugar supplier and the pie plate maker. Like those in the pie industry I suspect that the workers in our automotive industry, like their shipbuilding brethren, are not particularly comfortable about their future prospects.

I would argue that Canada needs a transparent manufacturing sector strategy. Essentially a strategy focuses your thinking on what you wish to achieve and gives broad direction as to how it may be done. Strategy forms the base from which innovation can flourish. With a well-defined strategy comes purpose. Without a strategy much good effort in both government and the private sector can prove to be wasted, futile and costly. In my view the formulation of an industrial strategy for this country is the raison d’être for Industry Canada.

In November of 2006 members of the shipbuilding industry, ship owners, offshore industries and various other interested marine industry stakeholders met with the Minister of Industry and his advisors to discuss the problems facing the shipbuilding industry. At that meeting the Shipbuilding Association made three recommendations to the Minister for his consideration. They were:

- Reinstate the Structured Financing Facility and combine it with Accelerated Capital cost Allowance for Canadian owners and operators;

- Adopt policies consistent with other shipbuilding countries to encourage investment in domestically built ships; and

- Create a shipyard environment and transformation fund on a 50/50 cost share basis with industry.

These three recommendations could form the foundation for an industrial strategy for the shipbuilding sector. Unfortunately to this date there has been nothing forthcoming to the industry.